Uniunea Europeană oferă un nou sprijin Republicii Moldova pentru consolidarea sectorului financiar

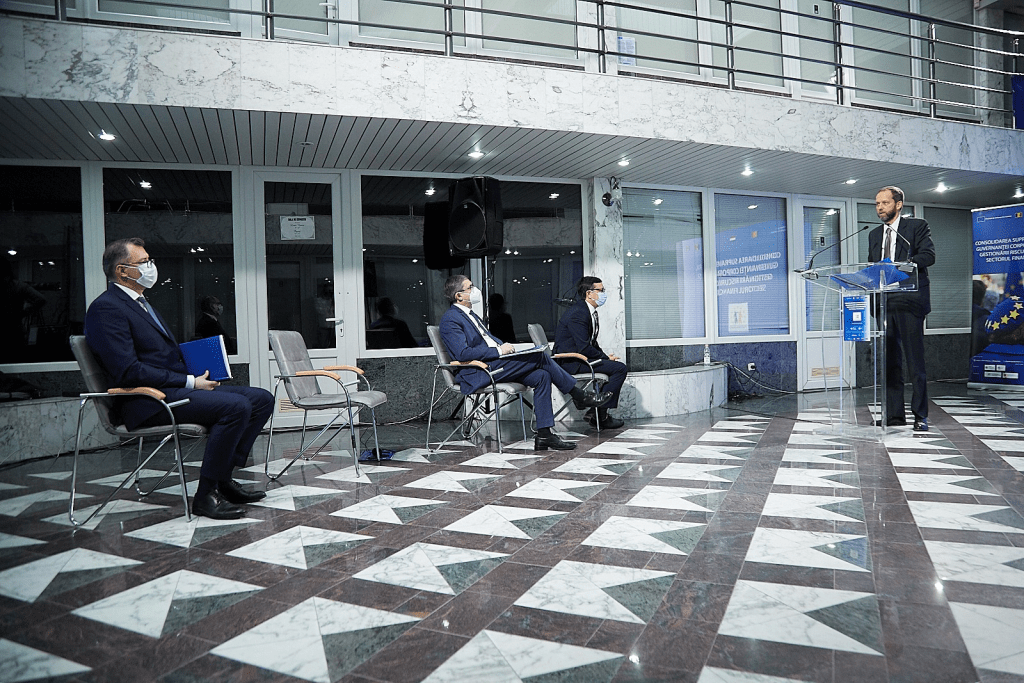

Uniunea Europeană lansează un proiect major de Twinning pentru a consolida supravegherea, guvernanța corporativă și gestionarea riscurilor în sectorul financiar al Republicii Moldova.

Banca Națională a Moldovei (BNM) și Comisia Națională a Pieței Financiare (CNPF) vor beneficia în următorii doi ani de sprijinul acordat de Uniunea Europeană pentru dezvoltarea și reformarea în continuare a sectorului financiar al Republicii Moldova.

Instituțiile partenere ale UE, care vor oferi sprijin BNM și CNPF în cadrul proiectului Twinning, sunt Banca Națională a României, Banca Centrală a Regatului Țărilor de Jos și Banca Centrală a Lituaniei, în colaborare cu Autoritatea de Supraveghere Financiară din România și Autoritatea Națională pentru Protecția Consumatorilor din România.

„Twinning este un instrument excelent de asistență pentru dezvoltarea capacităților instituționale și un sprijin important în procesul de avansare a reformelor. Pot să afirm acest lucru, deoarece proiectul Twinning anterior, de consolidare a capacității BNM în domeniul reglementării și supravegherii bancare, a fost un proiect de succes… De data aceasta, asistența Twinning nu se va limita doar la sistemul bancar, dar va include și alte domenii-cheie cu impact pozitiv asupra economiei și a populației în general”, a evidențiat în discursul său de deschidere, guvernatorul BNM, Octavian Armașu.

La rândul său, președintele parlamentului, Igor Grosu, a declarat: „Un sistem financiar sigur, stabil, dezvoltat și transparent, supravegheat calitativ, este absolut indispensabil pentru o economie sănătoasă și orice decizie luată aici, la BNM, sau la CNPF, are repercusiuni directe asupra tuturor antreprenorilor și cetățenilor. Din partea noastră, a Parlamentului Republicii Moldova, vă asigurăm că acum în Moldova există voință politică pentru reforme necesare, în beneficiul cetățenilor și al antreprenorilor… Vă asigur de angajamentul nostru ferm, și al meu personal, în promovarea reformelor mult necesare și mult așteptate din sectorul financiar.”

Proiectul Twinning prevede, între altele, fortificarea și diversificarea instrumentelor de supraveghere macroprudențială, îmbunătățirea reglementării și supravegherii serviciilor de plată și a infrastructurilor pieței financiare, precum și asigurarea condițiilor necesare pentru aderarea Republicii Moldova la Zona unică de plăți în euro (SEPA).

„Uniunea Europeană se angajează să susțină reformele structurale care aduc beneficii de impact pentru Republica Moldova, cetățenii săi și comunitățile de afaceri. Sectorul financiar al țării a fost afectat semnificativ de frauda bancară din 2014. Acest lucru a fost cauzat de un cadru legal și de guvernanță insuficient de puternic al sectorului, corupție la nivel înalt și interese personale. Cu sprijinul acestui proiect de înfrățire al UE, instituțiile partenere din Republica Moldova vor primi asistență pentru gestionarea adecvată a aspectelor din sectorul financiar, inclusiv evaluarea riscurilor financiare, combaterea spălării banilor și, de asemenea, luarea de măsuri pentru aderarea la SEPA. Acest lucru va avea un impact pozitiv semnificativ asupra dezvoltării economice a țării”, a menționat ambasadorul Jānis Mažeiks, șeful Delegației UE în Republica Moldova.

„Actualul proiect de Twinning are o sferă largă de cuprindere, nu doar pentru sectorul bancar, ci și pentru piața financiară din Republica Moldova. Acesta vizează beneficii atât pentru Banca Națională a Moldovei, cât și pentru Comisia Națională a Pieței Financiare din Republica Moldova, prin consolidarea capacităților instituționale și a guvernanței, precum și prin dezvoltarea cadrului de reglementare, de supraveghere a cadrului operațional pentru funcționalitate sporită. Cu acest prilej, aduc deplină recunoștință partenerilor noștri – De Nederlandsche Bank, Lietuvos Bankas, precum și Autorități de Supraveghere Financiară din România și Autorități Naționale pentru Protecția Consumatorilor din România”, a subliniat guvernatorul Băncii Naționale a României, Mugur Isărescu.

În discursul său, președintele băncii centrale a Regatului Țărilor de Jos, Klaas Knot, a spus: „Scopul intermediar al proiectului este consolidarea capacităților Băncii Naționale a Moldovei și a Comisiei Naționale a Pieței Financiare, și alinierea funcțiilor și operațiunilor acestora la reglementările UE și standardele internaționale. Bineînțeles, obiectivul final depășește acest domeniu, vizând îmbunătățirea stabilității, funcționării și încrederii în sistemul financiar. În acest fel, cetățenii Republicii Moldova vor putea să-și construiască viitorul, știind că banii lor sunt în siguranță, vor putea efectua plăți fără probleme și vor putea obține credite pentru a-și procura o locuință sau a începe o afacere.”

În același timp, președintele consiliului Băncii Centrale a Lituaniei, Gediminas Šimkus, a remarcat că „împreună cu experți din cadrul băncilor centrale din România și Regatul Țărilor de Jos, vom sprijini Banca Națională a Moldovei și Comisia Națională a Pieței Financiare din Republica Moldova în alinierea structurii și supravegherii sectorului financiar la standardele Uniunii Europene și, astfel, să accelereze integrarea Republicii Moldova în Uniunea Europeană, precum și să atingă o creștere economică durabilă pe termen lung.”

Asistența proiectului va fi acordată și pentru consolidarea capacității organizațiilor de asigurări și de creditare nebancare prin alinierea cadrului de reglementare național la cel aplicabil în Uniunea Europeană.

Vicepreședintele Consiliului de Administrație al CNPF, Vitalie Lemne, a afirmat că „pe durata implementării proiectului, partenerii europeni și cei moldoveni, cu sprijinul UE, vor lucra împreună pentru a dezvolta un cadru eficient de reglementare și supraveghere a pieței financiare în conformitate cu acquis-ul și cele mai bune practici ale Uniunii Europene pentru a asigura aplicarea legislației aferente în mod corespunzător în scopul monitorizării și supravegherii prudențiale a instituțiilor financiare nebancare și menținerii stabilității financiare”.

Potrivit estimărilor echipei de proiect, realizarea cu succes a proiectului va oferi investitorilor locali și celor din străinătate oportunități de a participa la dezvoltarea durabilă a pieței financiare locale, cu un nivel înalt de siguranță, cu produse și servicii financiare calitative, care să răspundă cât mai bine necesităților actuale ale diverselor categorii de consumatori și clienți.

Proiectul Twinning „Consolidarea supravegherii, guvernanței corporative și gestionării riscurilor în sectorul financiar ”, finanțat de Uniunea Europeană, a fost lansat astăzi pentru o perioadă de doi ani.

Pentru informații suplimentare despre proiect, vă rugăm să adresați solicitările la următoarele adrese: press@bnm.md; Twinning_2021@bnm.md; twinning-md@bnro.ro

Notă:

Twinning este un instrument al UE de cooperare instituțională între autoritățile statelor membre ale UE și autoritățile țărilor beneficiare. Proiectele Twinning urmăresc scopul de a dezvolta capacitățile instituționale ale autorităților beneficiare. În cadrul acestor proiecte, experți din sectorul public din UE sunt detașați pentru a oferi asistență autorităților beneficiare în vederea atingerii unor obiective specifice. Mai multe informații privind instrumentul de asistență Twinning sunt disponibile pe pagina web a Comisiei Europene.

Anterior, în perioada 2015-2017, BNM a beneficiat de un proiect Twinning pentru consolidarea capacității sale în domeniul reglementării și supravegherii bancare în contextul cerințelor UE, iar CNPF a beneficiat de un proiect Twinning pentru dezvoltarea și consolidarea capacităților sale operaționale și instituționale în domeniul reglementării și supravegherii prudențiale a pieței de capital, a fondurilor de investiții, a companiilor de asigurări, a asociațiilor de economii și împrumut și a fondurilor de pensii.